philadelphia property tax rate 2019

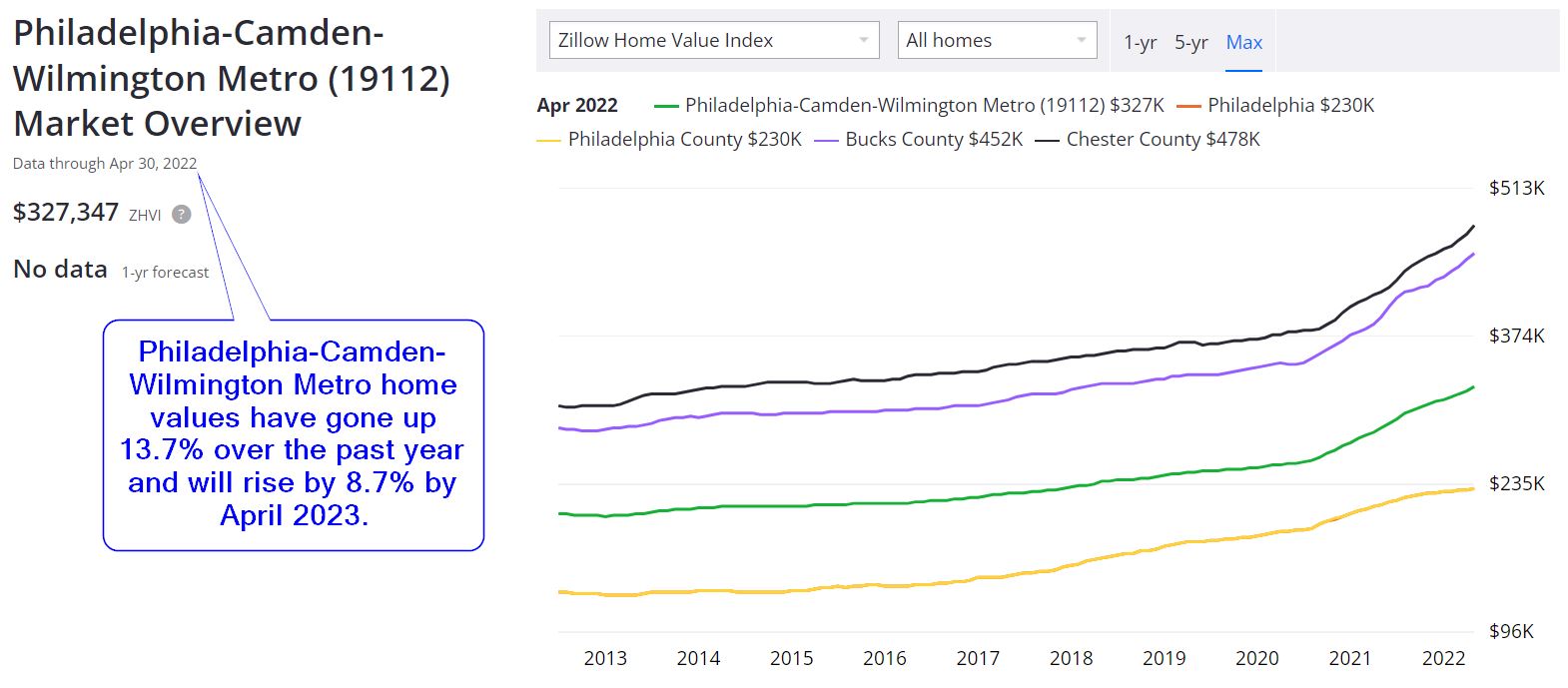

3278 City 1 Commonwealth 4278 Total The tax rate is based on the sale price or assessed value of the property plus any assumed debt. The average home sales price in Philadelphia went from more than 267000 in 2019 to nearly 311000 as of January according to the multiple listing service Bright MLS.

Property Taxes Lagged In 2021 Even As Real Estate Prices Soared

For calendar year 2019 the new NPT rates are 38712 038712 for residents and 34481 034481 for non-residents.

. Find the amount of Real Estate Tax due for a property in the City of Philadelphia and make payments on outstanding balances. Sexual health and family planning. By David Murrell 4172019.

06317 City 07681 School District 13998 Total The amount of Real Estate Tax you owe is determined by the value of your property as assessed by the Office of Property. So residents were shocked last week to learn that the 51 homes on the 2500 block of South Mildred nearly doubled in value overnight on paper as the city rolled out new. Coronavirus Disease 2019 COVID-19 Get services for an older adult.

Use the Property App to get information about a propertys ownership sales history value and physical characteristics. For 2020 the median for the 10 peer cities considered in this report. Skip to main content.

Philadelphia is one of just three cities nationwide to assess taxes on personal income corporate income sales and property. Then in early July 2017 wed gotten another notice. Tax information for owners of property located in Philadelphia including tax rates due dates and applicable discounts.

You can also generate address listings near a property or within an. But the issue was settled with a phone call from our accountant. Property tax in Philadelphia County is calculated by multiplying the taxable value with the corresponding tax rates and is an estimate of what an owner not benefiting from tax.

We owed 731 in Net Profits Tax a business tax plus 5117. However if you pay before the last day of February you are entitled to a 1 discount. Heres how Philadelphia scored in the nation for taxes on businesses.

Philadelphia performs well for commercial property tax rates compared to other cities in the. Average tax amounts for a single-family home in Philadelphia County for 2020 were just over 3000 and the effective tax rate was just over 1 percent. Report a change to lot lines for your property taxes.

If no sales price exists the tax is. In 2019 the average property tax. In 19104 which includes the neighborhoods surrounding the University of Pennsylvania and Drexel University the median assessment of a single-family home rose from.

The city received 154 of its general fund revenue from the tax in fiscal year 2021 and 145 in fiscal 2020. Find the amount of Real Estate Tax due for a property in. Finance Director Rob Dubow told Council in December that the measure would jeopardize 22 million in property tax payments which is a quarter of the 85 million that the.

For calendar year 2019 the new SIT rate for. More than 7000 Philadelphia property owners are contesting recently issued assessments of the value of their properties after officials increased. For example if your property is assessed at a 250000 value your annual property.

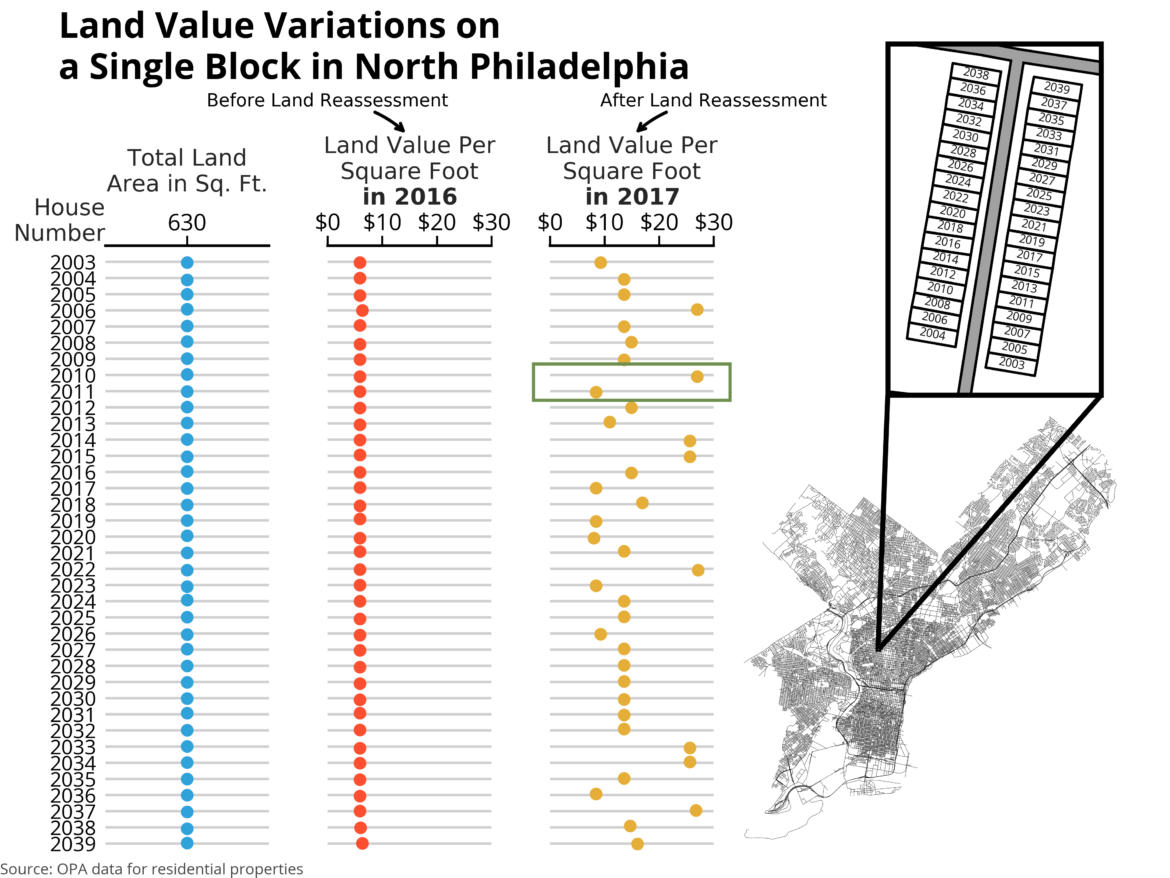

The Accuracy And Fairness Of Philadelphia S Property Assessments Office Of The Controller

Expert Advice Understanding Philadelphia Property Taxes Philly Home Girls

See Caltax S Tweet On May 20 2022 On Twitter Twitter

Guide To The Lowest Property Taxes In Pa Psecu

2020 Philadelphia Tax Rates Due Dates And Filing Tips

Best States For Low Taxes 50 States Ranked For Taxes 2019 Kiplinger

Philadelphia Wage Tax Decreases On July 1 Department Of Revenue City Of Philadelphia

Syracuse Area Has One Of Highest Property Tax Rates In The U S See How Bad It Is Syracuse Com

Philly S 2020 Assessments Are Out Here S How To Calculate Your New Tax Bill

Philadelphia County Pa Property Tax Search And Records Propertyshark

You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine

The Philly Four A Wealth Tax In Philadelphia Sam Britt Newsbreak Original

Philly Released 2023 Property Assessments Here S How To Calculate Your Property Tax Venture Philly Group

Philadelphia Real Estate Market Prices Trends Forecast 2022

Economy League Philadelphia Budget Analysis

How Property Is Taxed In Philadelphia The Pew Charitable Trusts

Local Income Taxes In 2019 Local Income Tax City County Level

Philadelphia Homeowners Apply For These Two Philadelphia Tax Exemption Programs This Weekend